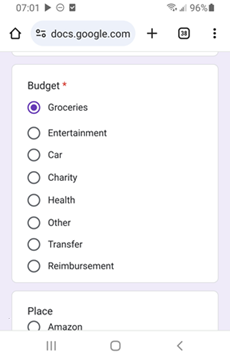

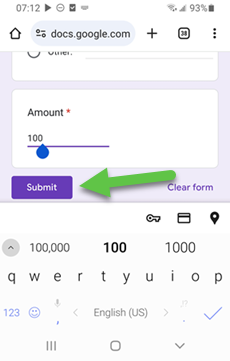

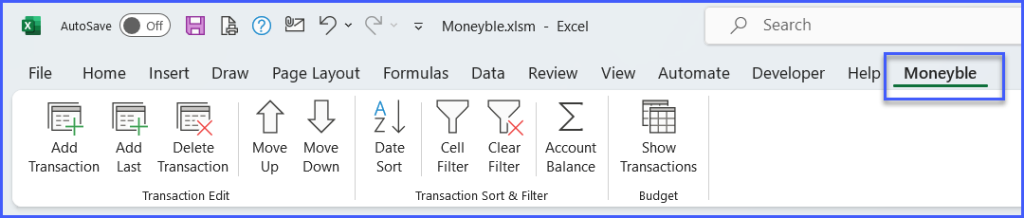

1. Cell phone transaction entry. An icon (like an app) will appear on your phone home screen. Actually it’s not an app. It is just a link to a Google Form. To design your form follow instructions inside Moneyble.xlsb file. The form is used on a phone. But you have to make it on Windows or Mac. The form will have your accounts, budget categories, frequently used vendors. You can also enter new vendor names and other comments. You can also attach receipt picture.

Requires free Google account (which most people already have)

2. Bank statement import. This can be used to gather all recent transactions from your bank(s) in one central place with your budget categories. Looking at transactions from last 6-12 months may reveal some interesting facts about your spending habits. You can also periodically import transactions this way. It will assign transactions to budget categories once the spreadsheet learns what budgets you’ve used before for these vendors. A very simplistic built-in AI engine. You just need to teach your rules to this AI engine. Either download a CSV file from your online banking. And then copy-paste transactions from the CSV to this template. Or you can copy-paste directly from the web page of the online banking if your bank does not provide CSV/Excel transaction download. If you are copy-pasting directly from the web page – you might need to clean it up. See more instructions inside the Excel template.

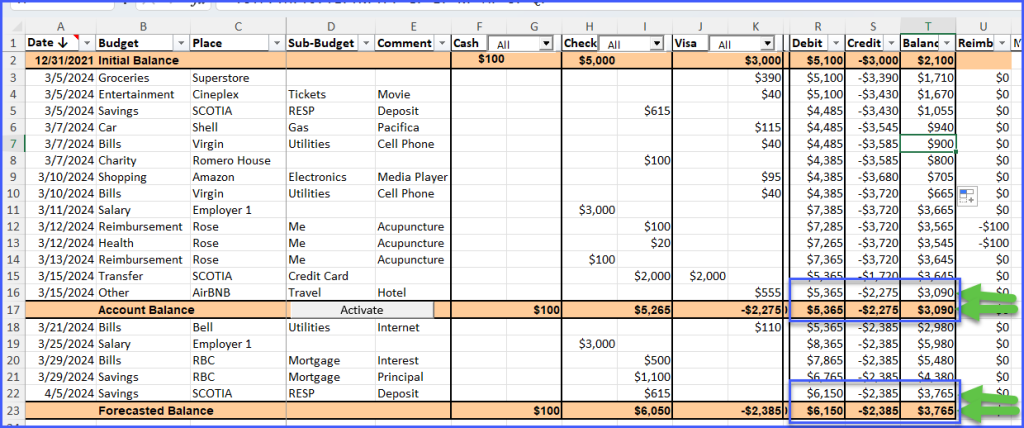

3. Subscriptions that generate transactions based on schedule – utility bills, mortgage, car loan, etc. Depending on your spending habits this may significantly reduce manual transaction entry. Subscription transactions are approved/generated with a single click.

Also, upcoming subscriptions generate your cash forecast. You will see not only how much money you have right now but also how much you will have on any given day within a month. Making sure checking account has enough funds to cover upcoming bills. It will help you avoid unwanted overdraft fees or unexpected interest payments.

Seeing all your subscriptions/monthly bills in one place makes cleaning-up easy. We all occasionally subscribe to something that we do not need. We may be paying it for months if not years without actually using the services.

If you have used Excel as a tracking tool before – you know Excel formulas can be a pain. One formula gets out of sync somewhere. And you are spending hours looking for the bad spot. This template solves this problem.

Additionally: Key formulas are cross-checked. Example: Transaction grand totals and the last transaction rolling total produce the same result but are calculated differently. If the cell values match – all formulas are correct. If the cells do not match – you know there is a formula problem somewhere. This is Excel – you have to have safeguards to ensure data integrity. Really the goal here is to make money tracking enjoyable by eliminating confusion and providing convenient and fast ways to enter and analyze data.

Hint: Round transactions to the nearest $5 or whatever makes sense to you in your currency. This will speed up transaction entry and will produce cleaner monthly data. Bank statement import can also round up transactions automatically (see Import sheet in Moneyble.xlsb)