Moneyble Excel Template provides tools in 3 key areas for individuals and families:

- Transaction Tracking

- Account Balances / Net Worth

- Budgeting

These 3 functions combined together enable clarity (transactions), provide motivation (account balances) and maximize savings (budget).

Moneyble Excel Template can also be used for a small business. If business operations are simple enough. The key goal of this template is speed. So it has to be efficient.

Transaction Tracking – Income, Expenses, Transfers between accounts, Savings. Yes, in some cases Savings could be a transaction. Example: you pay off your mortgage. Principal part of the payment can be considered savings while interest paid is generally an expense. You save money for education. Savings transaction transfers money from a checking account to the education savings account. A transaction is necessary as your checking account balance is reduced. While your savings account balance goes up. Every increase or decrease of the balance is recorded as a transaction. In business this is called General Ledger.

Net Worth. Or the balances of all the accounts and the value of all the assets your own. Minus all the outstanding loans. Net Worth is simply a SUM of all the transactions. Balance Sheet in business terms.

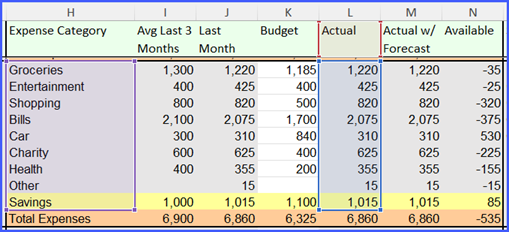

Budgeting – setting goals. Per category. Per period (month). Anticipated income MUST exceed anticipated spending. Periods are very important. When periods are consistent – you can compare. Compare to last month. Compare to the same month last year. Compare to month’s average.

Important to remember: Typically people focus on the net worth. How much money I need in order to retire? How much money I need for vacation? But really Net Worth alone is not a performance measure. Budgeting provides true KPI-s for measuring how much and how fast you can save. While Net Worth is only a snapshot in time. It is important to know your Net Worth. But Net Worth alone can be misleading if other factors are not considered.